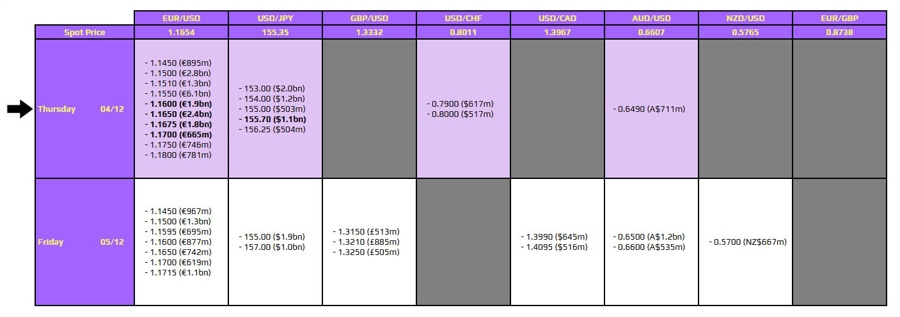

UPDATE: FX option expiries for December 4 at 10 AM New York time are making headlines today, influencing currency movements significantly. The notable expiries focus on EUR/USD, with key levels layered between 1.1600 and 1.1700, particularly concentrated around 1.1650. This is expected to keep price action tight as the market navigates through the session.

The prevailing trend of a weaker dollar is providing support to the EUR/USD pair this week. However, with large expiries looming, traders should brace for potential limitations on price movements today before these expiries roll off later in the session.

In addition, USD/JPY is facing pressure with an expiry at 155.70, which is closely aligned with the 100-hour moving average of 155.67. This proximity suggests that any upside extensions could be curtailed in the near term. The pair has shown signs of weakness since yesterday, reflecting a softer dollar amidst renewed expectations for a potential rate hike by the Bank of Japan (BOJ) this month.

Market participants are advised to monitor these developments closely as they could have immediate implications for trading strategies. The focus remains on how these key expiries will shape the currency landscape in the coming hours. For more insights, visit InvestingLive for detailed analysis and updates.

Stay tuned for further updates as this situation evolves, and ensure you are prepared for any sudden shifts in the market driven by these significant FX options.