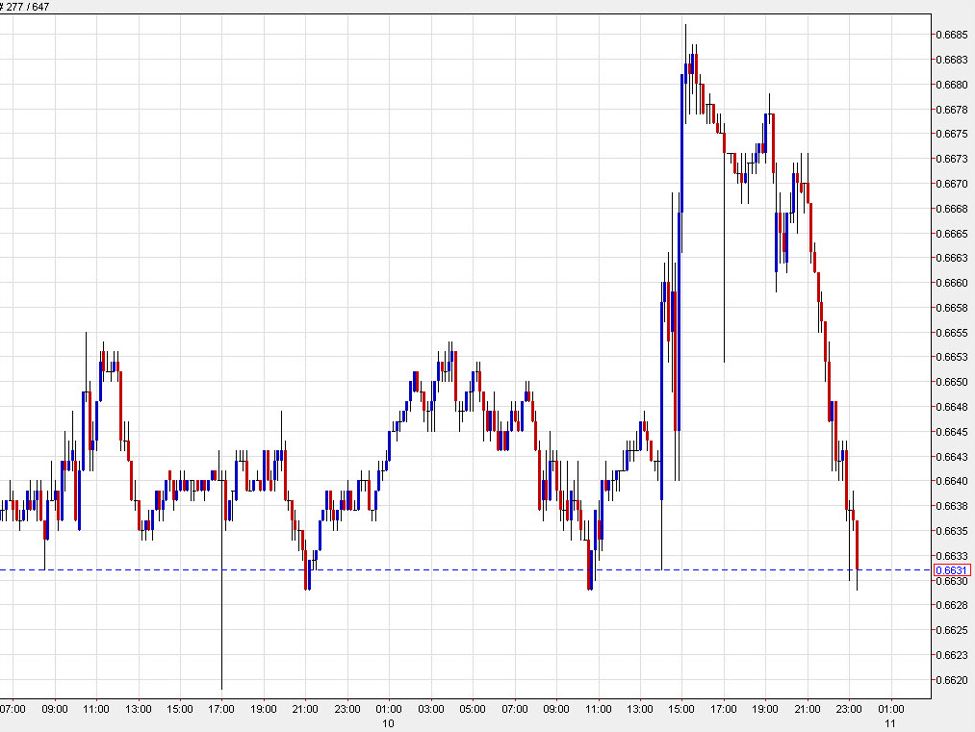

URGENT UPDATE: The Australian Dollar (AUD) has sharply declined against the US Dollar (AUD/USD) as traders unwind gains made earlier this week. Just hours ago, Asia’s trading session struggled to maintain momentum, leading to significant profit-taking following the Federal Reserve’s recent announcements.

This downturn comes after the Federal Reserve boosted its GDP growth forecast for 2026 from 1.8% to 2.3%. While this signals positive prospects for global growth and is beneficial for Australian commodity exports, the AUD’s recent performance reflects broader market trends and investor sentiment.

The trading landscape was further complicated by disappointing earnings reports from tech giant Oracle, which have negatively impacted market confidence. As a result, the Australian Dollar could not sustain its position, and traders began to pull back amid the ongoing AI-overspend narrative that has plagued the tech sector.

In addition to these factors, the Australian market faces headwinds from sluggish performance in Chinese stocks. Concerns over China’s economic trajectory have dampened optimism for Australian exports and economic recovery. Many analysts believe that without a significant shift in market dynamics, traders may need to wait until 2026 for a substantial rebound.

As of now, traders and investors are closely monitoring these developments. The AUD’s performance underscores the volatile interplay between global economic indicators and local market responses. The focus shifts to upcoming financial reports and economic data that could influence future trading decisions.

Stay tuned for more updates as this situation evolves. The financial landscape is unpredictable, and investors must remain vigilant.