UPDATE: As the holiday season approaches, financial analysts are confirming a potential Santa Claus rally in the stock market, driven by a surge in consumer spending and investor optimism. This phenomenon, which typically occurs in the final week of December, is gaining momentum as reports indicate an increase in holiday shopping and the reinvestment of year-end bonuses.

Consumer spending skyrocketed this December, with retail sales projected to rise by 5-8% compared to last year, according to the National Retail Federation. This growth is largely attributed to robust online sales and the return of in-store shopping, as consumers seek to capitalize on holiday deals. Analysts predict that this festive spending spree will bolster stock prices as more investors enter the market.

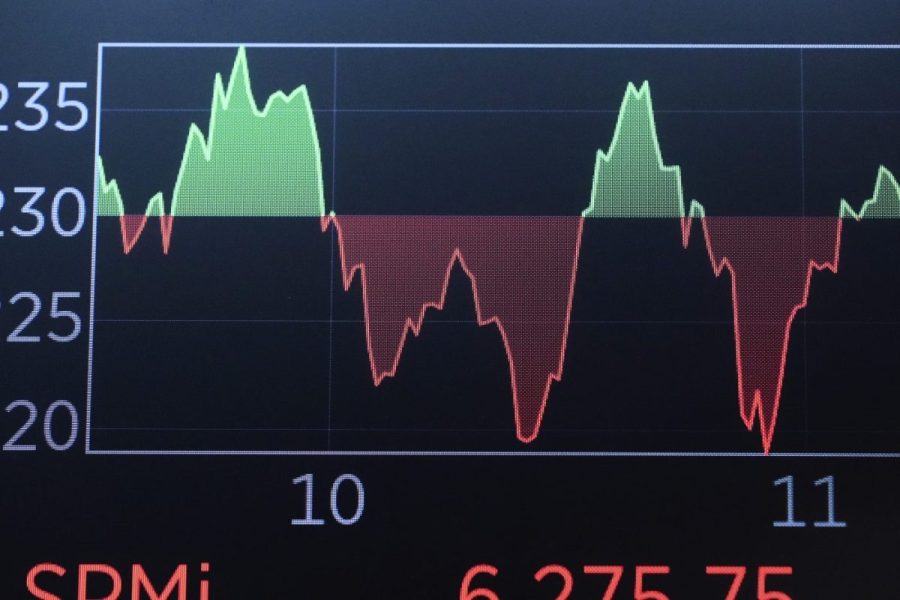

WHY IT MATTERS NOW: The Santa Claus rally could significantly impact investment portfolios before the year closes. Investors are closely monitoring market trends as they prepare to make last-minute financial decisions that could influence their year-end earnings. With the potential for substantial gains, many are eager to cash in on the festive financial mood.

Authorities report that the optimism is also fueled by the anticipated distribution of $1 trillion in bonuses, which many workers will receive this month. Financial experts believe that these bonuses will likely be reinvested into the market, further driving up stock prices.

WHAT TO WATCH FOR: As December progresses, keep an eye on retail performance reports and consumer confidence indices. Both will provide critical insights into the sustainability of the projected rally. If consumer spending continues to rise, we could see a notable surge in major stock indices, making this an ideal time for investors to position themselves for year-end gains.

In summary, the combination of increased shopping and significant bonus payouts is setting the stage for a potential Santa Claus rally that could impact market dynamics. Investors are advised to stay informed and consider their strategies as we approach the final weeks of 2023.

This developing story will be updated as new data emerges. Share this article to keep your network informed about the latest market trends heading into the new year.