URGENT UPDATE: A groundbreaking report from Virginia-based research institute AidData reveals that China’s global loan portfolio has skyrocketed to a staggering $2.1 trillion, significantly reshaping the global financial landscape. This development comes amidst rising concerns regarding China’s expanding influence through its lending practices, particularly under the controversial Belt and Road Initiative.

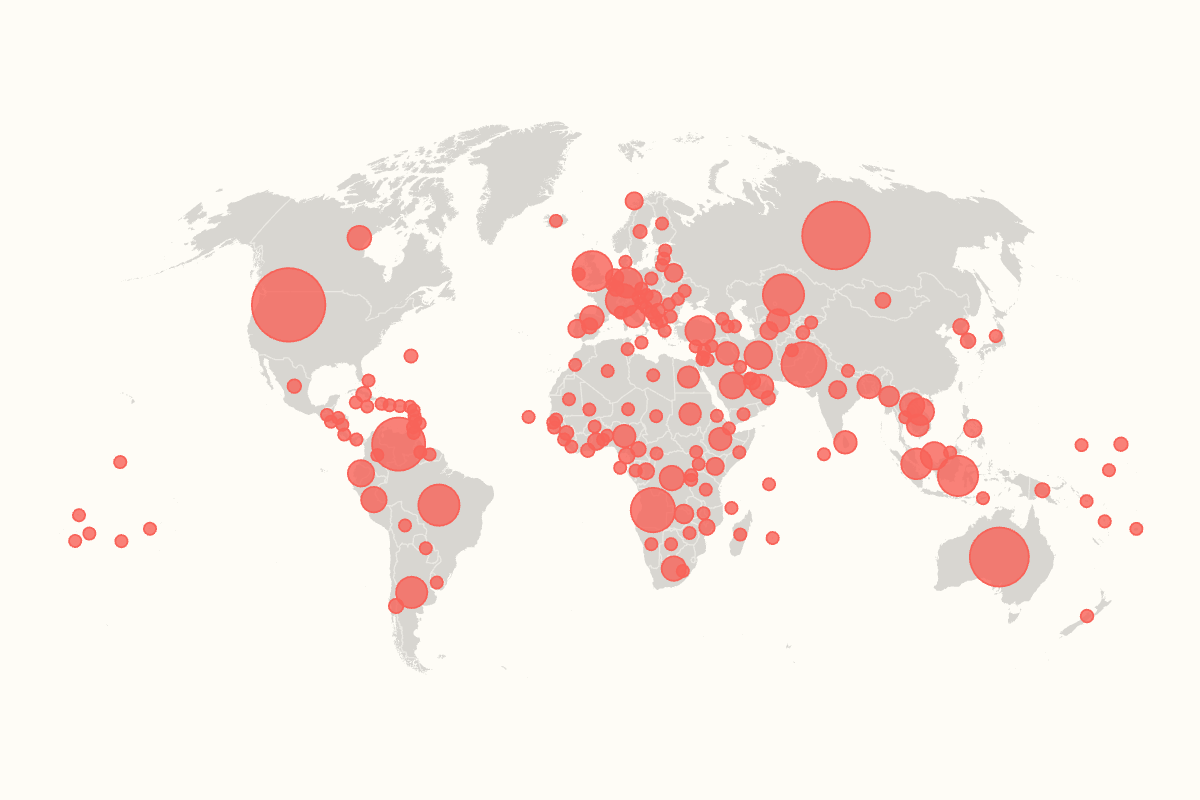

The AidData report, based on a comprehensive three-year study monitoring 30,000 projects across 217 countries, indicates that China has become the world’s largest creditor, surpassing previous estimates by two to four times. This revelation is crucial, as it challenges the long-held belief that Chinese loans primarily target developing nations.

Among the top recipients, the United States leads with $202 billion in loans for 2,500 projects nationwide. Russia follows closely with $172 billion, while Australia ranks third with $130 billion. Venezuela and Pakistan are also significant recipients, receiving $105.7 billion and $75.6 billion, respectively. Surprisingly, the United Kingdom, the sixth-largest economy, is listed as the tenth-largest recipient of Chinese loans.

The implications of these findings are profound. Critics of China’s lending practices have long accused the country of engaging in “debt-trap diplomacy,” where high repayment demands lead to financial distress and increased influence over critical infrastructure in borrowing countries. However, Chinese officials vehemently deny these claims, asserting that their overseas lending is grounded in mutually beneficial, market-driven principles.

In light of the latest data, Brad Parks, executive director of AidData, stated, “This is an extraordinary discovery given that the U.S. has spent the better part of the last decade warning other countries of the dangers of accumulating significant debt exposure to China.” Meanwhile, Yang Baorong, director of African Studies at the Chinese Academy of Social Sciences, emphasized that China’s financing is aimed at enabling self-reliance through infrastructure development, not dependency.

The findings raise urgent questions about how other major lenders, including the U.S., Germany, and Japan, will respond to China’s growing influence in global finance. As the report describes China as a “new global pace-setter rewriting the rules and norms” of international aid and credit, these nations may need to reassess their strategies to remain competitive.

With China not disclosing official data on its foreign lending practices, AidData’s analysis relied on a variety of sources, including loan contracts, grant records, and debt restructuring agreements. This lack of transparency has fueled ongoing debates about the true scale and impact of China’s lending practices on global economic stability.

As the international community grapples with these revelations, the need for greater accountability and transparency in global lending becomes increasingly clear. Stay tuned for more updates on this rapidly evolving situation as authorities and analysts seek to understand the full implications of China’s burgeoning role in global finance.

This urgent development not only redefines the landscape of international lending but also significantly impacts diplomatic relations and economic strategies worldwide.