UPDATE: ECB’s Mārtiņš Kazaks has just indicated that the next interest rate move could likely be a hike rather than a cut, sending the EURUSD soaring in the New York trading session. As the U.S. market opens, the currency pair has rebounded sharply, erasing earlier losses and trading higher.

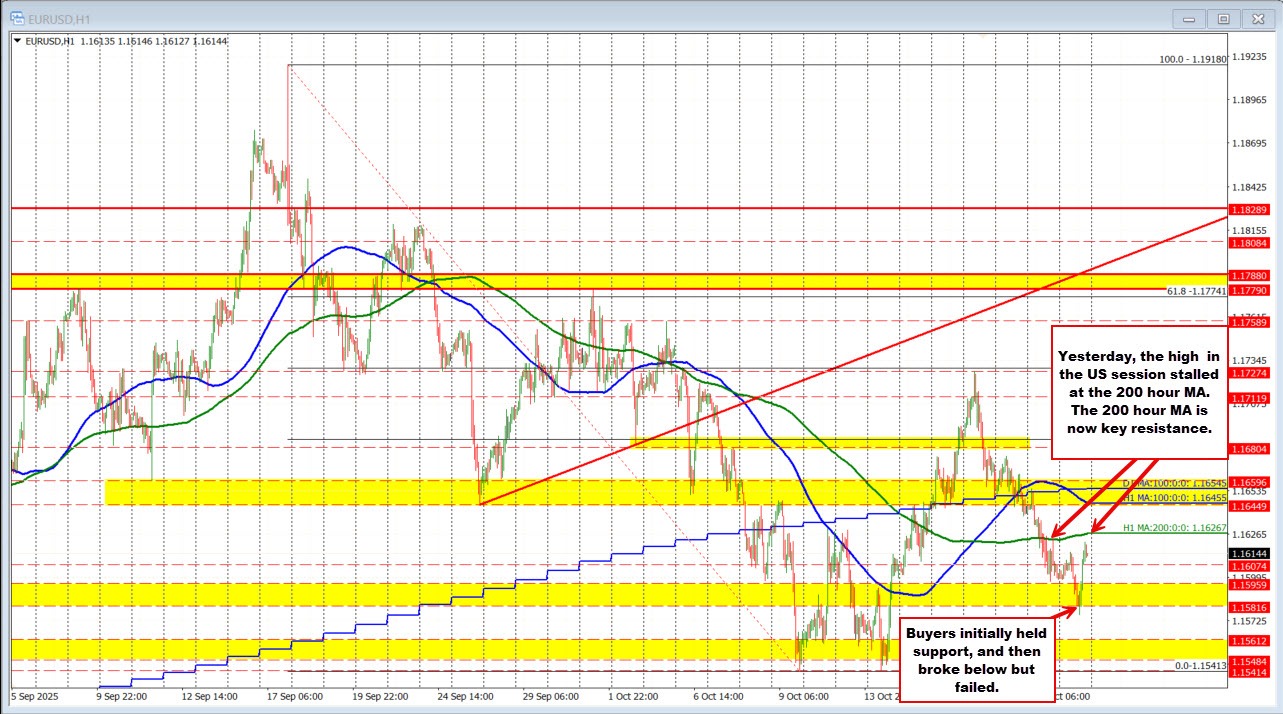

Earlier today, the EURUSD dipped below a critical support zone between 1.1581 and 1.15956, hitting a session low of 1.1578. However, the downward movement failed to gain traction. Once prices reclaimed that support zone, sellers were compelled to cover their positions, fueling a significant recovery during the morning hours in New York.

The momentum intensified as the EURUSD surpassed the prior session high of 1.1615, reaching an intraday peak of 1.1622. This rally brings the currency pair within striking distance of the 200-hour moving average, currently positioned at 1.16267. This level is crucial, as a sustained break above it could hand control to buyers and shift the short-term bias to the upside.

Kazaks’ remarks coupled with this bullish movement highlight a pivotal moment for traders. If the EURUSD maintains its position above 1.1615 to 1.1622, it may establish a new upward trend. However, should the pair fail to hold above these levels, traders could see it drift back toward the 1.1595 to 1.1580 support zone, where buyers have previously stepped in.

As the trading day progresses, all eyes are on the 1.1627 level. A breakout above this threshold strengthens the bullish case, while failure could signal a return to the broader consolidation trend observed in recent sessions. Traders and investors are urged to stay alert as these developments unfold, with Kazaks’ insights adding a layer of urgency to the market behavior.

This situation presents both opportunities and risks, making it essential for market participants to monitor fluctuations closely. The implications of the ECB’s stance on interest rates could have far-reaching effects, not just on the EURUSD but across global financial markets.