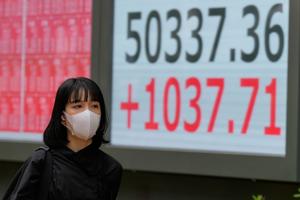

U.S. futures surged early on Monday, and global shares displayed a mixed performance following remarks from U.S. President Donald Trump, who expressed optimism about a potential trade agreement with China. Asian markets responded positively, with Japan’s Nikkei 225 index climbing 2.5% to close at 50,512.32, marking a new high.

European markets remained relatively stable, with Germany’s DAX gaining 0.2% to reach 24,279.53. Meanwhile, France’s CAC 40 slipped 0.1% to 8,218.42, and the UK’s FTSE 100 also declined by 0.1%, settling at 9,640.12. Futures for the S&P 500 increased by 0.9%, and the Dow Jones Industrial Average rose by 0.6%, reflecting investor confidence stemming from anticipated trade progress.

Trump’s comments followed a visit to Malaysia, where he participated in a summit with Southeast Asian nations. During the summit, he mentioned forging preliminary trade agreements with Malaysia, Thailand, Cambodia, and Vietnam. “I have a lot of respect for President Xi,” Trump stated, emphasizing his belief that a deal could be reached with the Chinese leader during an upcoming meeting.

Investor sentiment in Asia was buoyed by news of a tentative consensus between the U.S. and China, which aims to alleviate ongoing trade tensions. Stephen Innes, a market analyst from SPI Asset Management, remarked, “This isn’t just photo-op diplomacy. Behind the showmanship, Washington and Beijing’s top trade lieutenants have quietly mapped out a framework that might, just might, keep the world’s two largest economies from tearing up the field again.”

As Trump continues his Asian tour, he is expected to meet Xi on the sidelines of the Asia-Pacific Economic Cooperation (APEC) forum in South Korea.

Japan’s political landscape also contributed to market movements, as newly installed Prime Minister Sanae Takaichi enjoys significant public support due to her pro-market policies. Following her debut at the regional summit, stocks in defense contractors surged, with Kawasaki Heavy Industries rising 9%, IHI Corp. gaining 2.8%, and Hitachi increasing by 3.7%.

In the context of U.S.-Japan trade discussions, it was noted that Japan’s government is considering purchasing a fleet of Ford F-150 trucks for infrastructure inspections as part of negotiations aimed at easing trade tensions.

Meanwhile, South Korea’s Kospi index rose 2.6% to a record 4,042.83, driven by investor hopes surrounding a potential trade deal. Australia’s S&P/ASX 200 gained 0.4% to reach 9,055.60, while Taiwan’s Taiex increased by 1.7% and India’s Sensex rose by 0.7%.

Despite the overall positive sentiment regarding trade agreements, a report released by the APEC secretariat forecasted that annual growth in the Pacific region is expected to slow to 3% this year, down from 3.6% in 2022. This slowdown is attributed to ongoing trade restrictions and heightened tariffs.

On Wall Street, stocks reached record highs on Friday, buoyed by inflation data that was less concerning than anticipated. The S&P 500 climbed 0.8% to 6,791.69, surpassing its previous all-time high, while the Dow Jones Industrial Average rallied 1% to hit 47,207.12. The Nasdaq composite also rose 1.1% to a record 23,204.87.

Encouraging inflation data suggests potential relief for lower- and middle-income households grappling with rising prices. More importantly for the markets, it could provide the Federal Reserve with the opportunity to continue cutting interest rates to stimulate a slowing job market.

In commodities, U.S. benchmark crude oil prices fell, with a decrease of 66 cents to $60.84 per barrel. Brent crude, the international benchmark, declined by 67 cents to $64.53 per barrel. The U.S. dollar strengthened slightly against the Japanese yen, rising to 152.77 from 152.85, while the euro increased to $1.1639 from $1.1636.