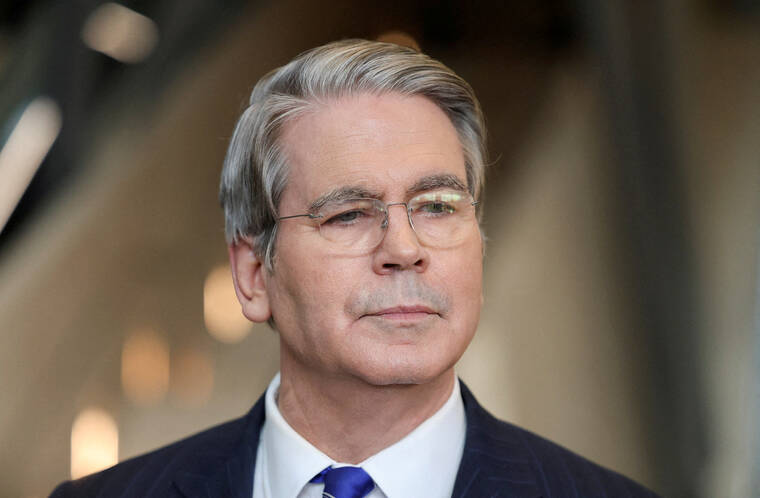

U.S. Treasury Secretary Scott Bessent indicated on October 1, 2023, that parts of the U.S. economy, particularly the housing sector, may already be experiencing a recession due to elevated interest rates. During an appearance on CNN’s “State of the Union,” Bessent reiterated his call for the Federal Reserve to expedite rate cuts to alleviate the financial pressures affecting consumers.

Bessent stated, “I think that we are in good shape, but I think that there are sectors of the economy that are in recession.” He attributed these economic challenges to the Fed’s current policies, which he believes have created significant distributional issues. Although he described the overall U.S. economy as stable, he noted that high mortgage rates continue to stifle the real estate market.

According to the National Association of Realtors, pending home sales in the United States remained flat in September. Bessent emphasized that the housing market recession disproportionately impacts low-income consumers, who often carry debts without significant assets. He characterized the economic environment as one in transition, urging for immediate action to prevent further downturns.

Concerns regarding the Federal Reserve’s monetary policy have intensified following comments made by Fed Chair Jerome Powell. Last week, Powell suggested the central bank may not pursue additional rate cuts during its upcoming meeting in December. This statement drew sharp criticism from Bessent and other officials from the Trump administration.

In an interview with the New York Times, Stephen Miran, a Federal Reserve Governor currently on leave from his role as chairman of the White House Council of Economic Advisers, warned that maintaining tight monetary policies could lead to a recession. Miran was among two central bank governors who dissented from the recent Fed decision to cut interest rates by 25 basis points, advocating instead for a more substantial cut of 50 basis points.

“If you keep policy this tight for a long period of time, then you run the risk that monetary policy itself is inducing a recession,” Miran stated in the interview. He added that there is no justification for this risk if inflation does not pose an imminent threat.

Bessent echoed Miran’s concerns, highlighting that the Trump administration’s reductions in government spending have improved the deficit-to-gross-domestic-product ratio to 5.9%, down from 6.4%. This improvement, he argued, could assist in lowering inflation. He encouraged the Fed to continue its trajectory of interest rate reductions, stating, “If we are contracting spending, then I would think inflation would be dropping. If inflation is dropping, then the Fed should be cutting rates.”

The ongoing debate surrounding the appropriate level of interest rates and their economic ramifications reflects a critical juncture for U.S. economic policy. As discussions continue, the impact on the housing market and broader economy will remain a focal point for policymakers and consumers alike.