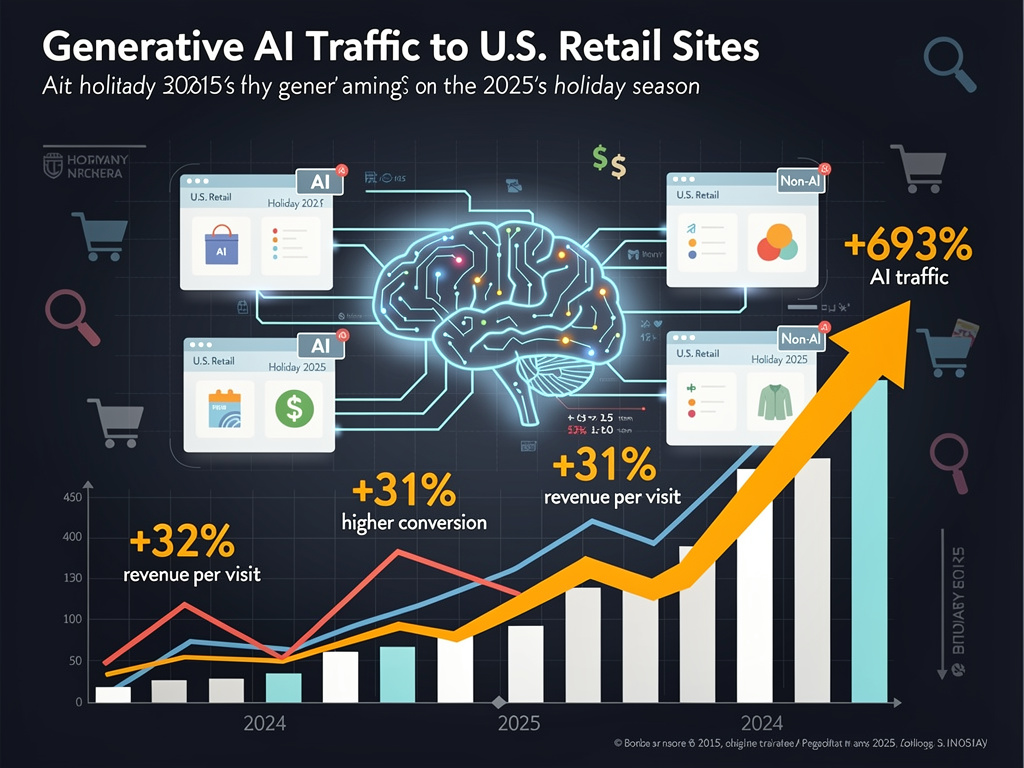

During the 2025 holiday season, U.S. retail websites experienced an unprecedented traffic surge, driven by generative AI tools such as ChatGPT, Gemini, and Perplexity. According to Adobe’s Quarterly AI Traffic Report, traffic increased by an astonishing 693% compared to the previous year, from November 1 to December 31. This increase was based on an analysis of over one trillion visits to retail sites and more than 100 million stock-keeping units.

AI referrals not only boosted site traffic but also demonstrated superior performance. Overall, AI-sourced visitors converted 31% more effectively than non-AI sources, with specific spikes of 54% on Thanksgiving and 38% on Black Friday. This marks a significant shift from 2024, when non-AI traffic outperformed AI by 51% in revenue per visit. In contrast, visitors sourced from AI in 2025 generated 32% more revenue per visit, alongside 14% higher engagement, 45% longer session times, and 13% more pages viewed per session.

AI’s Impact on Retail Performance

The remarkable growth in AI-driven traffic reflects a broader trend across various industries. Vivek Pandya, director of Adobe Digital Insights, noted, “AI-driven traffic surged across industries. This means for marketers and retailers alike, we saw deeper engagement translating directly into higher conversion during the 2025 holiday season.” The retail boom extended beyond holiday shopping, with AI referral growth skyrocketing in sectors such as travel (539%), financial services (266%), and technology/software.

Total U.S. online holiday sales reached a record $257.8 billion, up 6.8% from $241.4 billion in 2024. This growth was fueled by an increase in spending days, with 25 days exceeding $4 billion in daily sales compared to 18 the previous year.

AI has transformed from a novel tool to a key driver of commerce. Following a staggering 1,300% holiday traffic spike in 2024, revenue per visit from AI sources grew by 84% from January to July 2025, indicating a narrowing gap in value between AI and non-AI traffic. According to Adobe’s survey, 47% of consumers expressed confidence in AI results, underscoring the growing trust in these technologies.

On Black Friday, AI traffic surged by 805% year-over-year. Mobile transactions captured a significant 56.4% of all sales, peaking at 66.5% on Christmas Day. Buy-now-pay-later options also saw a notable increase, reaching $20 billion, up 9.8% from the previous year. Data from Salesforce corroborated these findings, revealing that AI influenced 20% of U.S. holiday retail sales, amounting to $262 billion globally.

Geographic and Economic Trends in AI Adoption

The adoption of AI tools varied significantly across regions and demographics. High-income states such as Virginia, Washington, New York, California, and Massachusetts generated 52% of U.S. AI traffic, showcasing engagement levels that were double the national average. Urban consumers exhibited higher awareness and usage of AI assistants, with 80% awareness, 48% usage in shopping, and 63% planning to increase their adoption in 2026. In contrast, rural areas lagged significantly behind.

Adoption trends also highlighted a digital divide, with states like Mississippi showing high online activity but low AI engagement. Nationwide, only 2% of consumers were unaware of AI assistants. A survey found that 46% had used AI for shopping, and 58% intended to do so in 2026. High-income areas led this trend, while southern and Appalachian regions trailed, illustrating the disparity in AI commerce uptake.

Broader surveys reinforced the consumer embrace of AI. A post-holiday poll by Talkdesk revealed that 88% of respondents used AI during the 2025 holiday season, with 56% reporting a positive experience and 69% indicating they were more likely to adopt AI shopping in the future. Deloitte indicated that 33% planned to use generative AI, double the rate from 2024, with increased trust reported by 26% of respondents.

As retailers adapt to this shift, tools like Perplexity and Claude have gained traction for research, deal-hunting, and gift ideas. Adobe observed that searches for phones peaked at 40% above 2024 averages before Thanksgiving, while toy-related searches surged 50% during Christmas week.

The urgency for marketers to optimize for AI discovery is palpable. A report indicated that 75% of brands plan to leverage AI for deals, up from 66% in 2024. Zeta Global reported a remarkable 25x growth in AI agent usage during holiday campaigns.

Despite the impressive growth, challenges remain, including high return rates of 28%, which pressure margins alongside tariffs and price sensitivity. Nevertheless, the anticipated 520% growth in AI before the next holiday season positions it as a pivotal battleground for retailers.

As the landscape shifts, Adobe’s data from 215 top retailers indicates the need for optimization. Bounce rates decreased as relevance increased; while desktop traffic still dominated at 86% early in 2025, mobile share climbed toward one-third. Looking ahead, 58% of consumers expressed interest in increased AI shopping.

Retailers who neglect this trend risk obsolescence, while those who embrace technologies like NVIDIA’s AI, which offers 95% cost reductions, stand to benefit significantly. Pandya concluded, “Marketers should continue to adapt as more consumers turn to large language models to research products, compare options, and make decisions.” The era of AI assistants in commerce is firmly established.