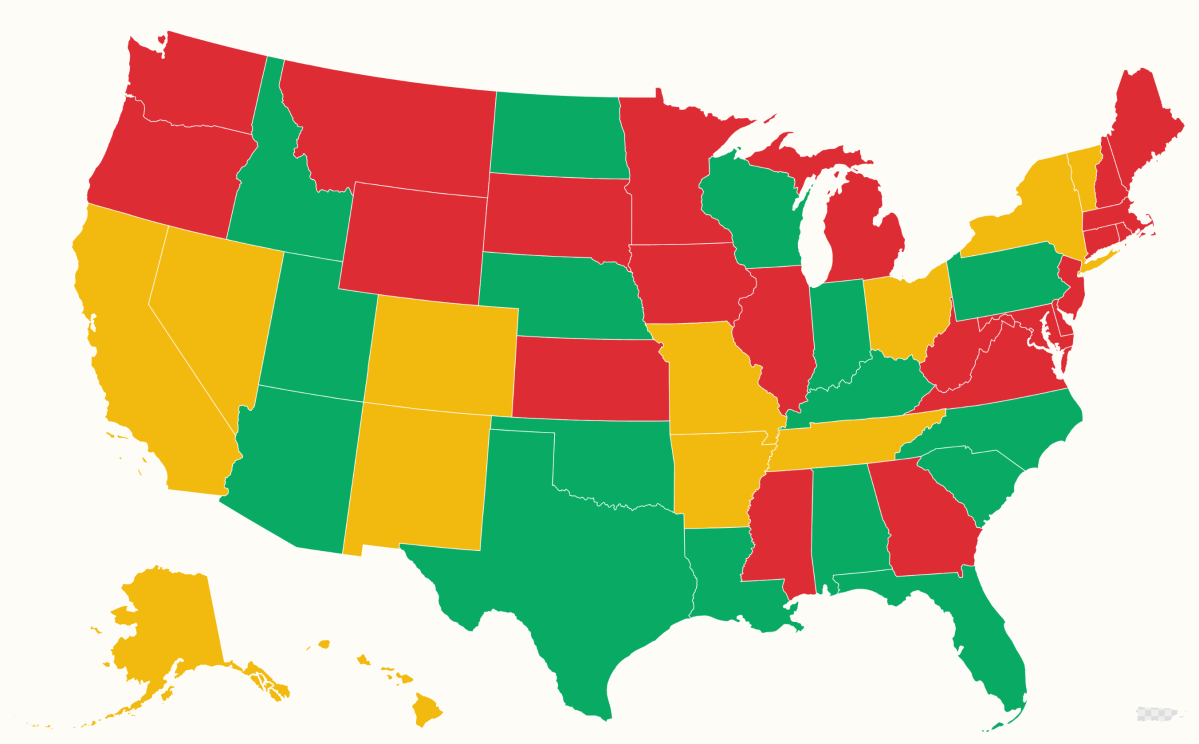

According to a recent analysis by Mark Zandi, chief economist at Moody’s Analytics, while the overall U.S. economy is experiencing growth, numerous states are showing signs of potential recession. Zandi’s report highlights that 22 states and Washington, D.C., which collectively account for almost a third of the nation’s GDP, are currently in or at high risk of entering a downturn.

Zandi notes, “These regions, spread across every part of the country, are showing signs of strain.” The analysis reveals that an additional third of states are merely “treading water,” while the remaining states are still growing, although their growth momentum appears to be waning.

Current Economic Landscape

Despite stronger-than-expected GDP growth of 3.8 percent in the second quarter, concerns persist regarding the U.S. economy’s stability. The administration asserts that any disruptions from tariffs will soon lead to significant economic expansion. However, Zandi warns that inflation, a softening labor market, and declining consumer confidence continue to threaten the economic outlook.

In his previous analysis published in August, Zandi identified 21 states and the capital as being in recession or at high risk. Since then, only Michigan has shifted from the “treading water” category to join the ranks of those experiencing serious economic difficulties.

Recessions are typically defined by two consecutive quarters of negative GDP growth. While the Bureau of Economic Analysis (BEA) reported GDP increases in 48 states during the second quarter, Zandi’s findings are based on a variety of economic indicators, including payroll employment, industrial production, and retail sales. His methodology aligns with that of the National Bureau of Economic Research (NBER), which retroactively determines U.S. recessions.

Zandi points to Washington, D.C., as particularly vulnerable, attributing its struggles to federal job cuts and furloughs. In contrast, Texas continues to thrive as an economic powerhouse, while both California and New York are categorized as “treading water.” The performance of these two states is crucial, as Zandi emphasizes that their economic health may significantly influence the national economy.

Potential Impacts and Future Outlook

In an interview with Newsweek, Zandi stated, “If California and New York weaken and start to contract, the national economy is going to go into recession.” Conversely, if these economies manage to stabilize or grow, the U.S. economy could avoid a downturn.

Concerns regarding a nationwide recession have intensified as job growth slows and the potential for tariffs to increase consumer prices looms. Joe Gagnon, a senior fellow at the Peterson Institute for International Economics, commented that companies have delayed price hikes, awaiting negotiations on tariffs. He anticipates that by September, firms will likely begin to raise prices in response to the realization that many tariffs will remain in place.

Mark Zandi remarked on the interplay of various economic factors, stating, “De-globalization, including the trade war and highly restrictive immigration policy, is a headwind to growth.” He also noted the positive impact of artificial intelligence on investment and spending, which may serve as a counterbalance to these challenges.

Federal Reserve Chairman Jerome Powell addressed the current labor market during a September conference, acknowledging the difficulties faced by new entrants to the workforce. He described the economy as a “low-hire, low-fire” environment, where companies are hesitant to increase hiring amid uncertainty.

As anticipation builds, the BEA is set to release an advance estimate for third quarter GDP growth on October 12, 2023. However, ongoing government shutdowns have paused many official data releases, including those from the Bureau of Labor Statistics and the Census Bureau. The forthcoming report will be pivotal in shaping economic expectations for the latter half of the year.