StockX has unveiled its seventh annual Current Culture Index, providing insights into the brands and products that dominated the secondary market in 2025. Released on January 12, 2026, the report highlights nearly 200 brands that achieved record sales on the StockX platform, illustrating the growing significance of the resale market across categories such as sneakers, apparel, and collectibles.

According to Greg Schwartz, CEO of StockX, “2025 wasn’t defined by a single category or trend — it was shaped by a number of standout releases.” He emphasized that brands that focused on innovation and strategic partnerships saw significant benefits. As the market continues to evolve, Schwartz noted that the brands poised for success in 2026 will be those that understand concepts of scarcity, storytelling, and community.

Key Insights from the 2026 Current Culture Index

The report outlines several significant trends in various categories, beginning with sneakers. For the third consecutive year, legacy brands such as Nike, Jordan, and adidas led the sales rankings. Following a period of decline, both Nike and Jordan showed signs of recovery with average sneaker prices increasing by 5% and 6% year-over-year, respectively.

Notably, the fastest-growing sneaker brand of 2025 was Mizuno, which experienced a remarkable 124% increase in sales, primarily due to its lifestyle-oriented designs. Maison Mihara Yasuhiro followed closely with a 91% growth rate, showcasing the appeal of its distinct chunky sneaker styles.

Outside the sneaker category, consumer preferences leaned towards comfort and creativity. UGG remained the top-selling shoe brand, bolstered by popular new products such as the UGG Zora Ballet Flat. Interestingly, Nike also emerged as the fastest-growing non-sneaker footwear brand, with a staggering 5,811% increase in sales driven by the ReactX Rejuven8, a new recovery-focused silhouette.

Growth Drivers in Apparel and Collectibles

Strategic collaborations have proven vital for apparel brands in the secondary market. Uniqlo was the fastest-growing apparel brand in 2025, with sales soaring 667% year-over-year, thanks to successful partnerships with designers like Needles and KAWS. SKIMS also made waves, achieving 196% growth through limited releases and collaborations with notable brands.

In the collectibles space, Pop Mart surpassed LEGO as the top-traded brand, reflecting a strong interest in “kidult” culture. In electronics, Canon saw a dramatic rise, climbing 19 spots to become the second-best-selling electronics brand on StockX, with over 6,000% growth due to the popularity of the Canon PowerShot G7 X Mark III.

The report also noted that scarcity continues to drive success in the accessories market. Sprayground ranked as the top-growing accessories brand, with an impressive 287% year-over-year increase. Demand for high-profile collaborations, such as Louis Vuitton’s latest partnership with Takashi Murakami, also contributed to strong sales.

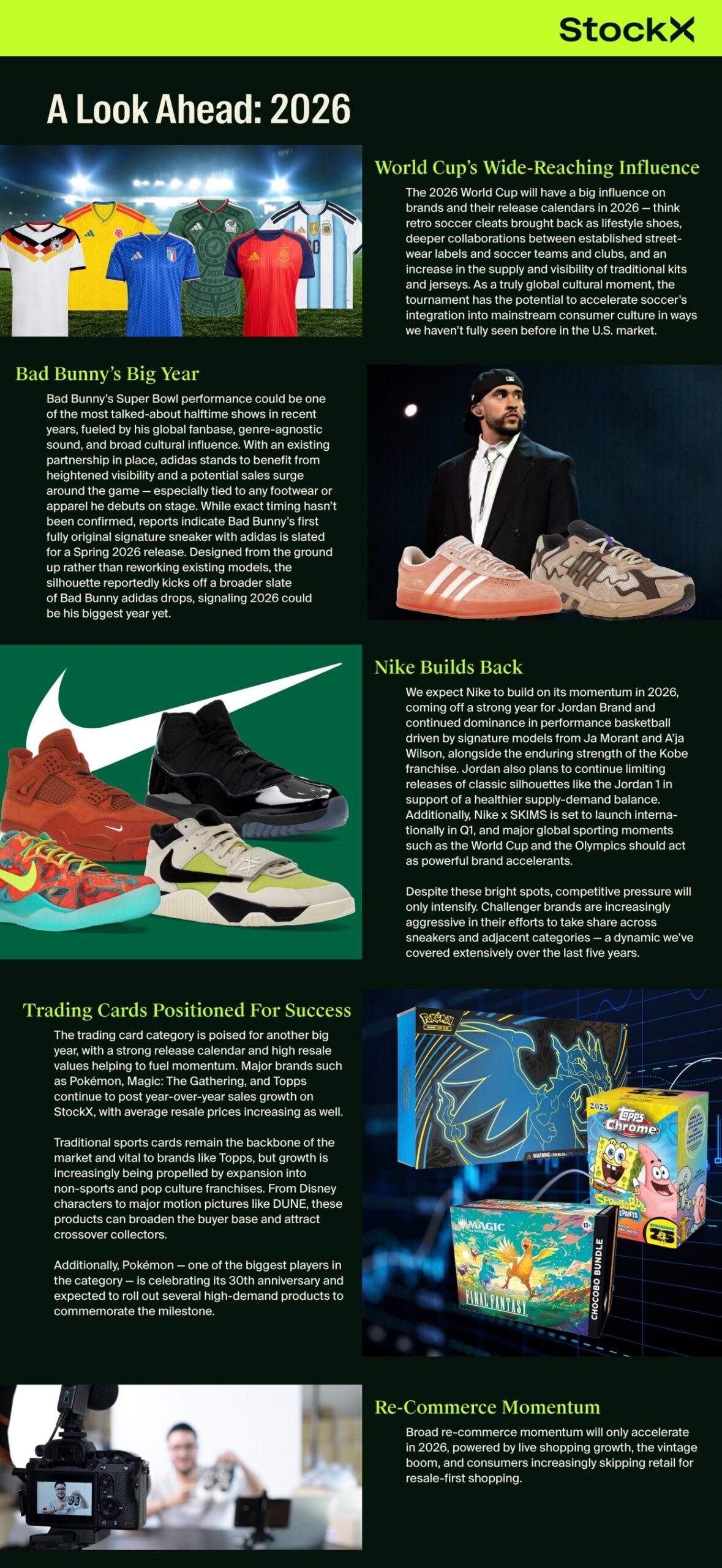

As StockX looks forward to 2026, several predictions have been made regarding market trends. The upcoming 2026 FIFA World Cup is expected to elevate soccer’s influence in U.S. fashion, while the Milan Olympics will present opportunities for brands to blend sport and fashion. Additionally, Bad Bunny is anticipated to have a standout year with a highly awaited Super Bowl halftime performance and the launch of his first original signature sneaker with Adidas.

The insights from StockX’s Current Culture Index suggest that as consumer behavior continues to shift towards resale shopping, driven by live shopping and vintage demand, brands that adapt to these changes will be best positioned for success. For more details, the full report can be accessed on the StockX website.