The biopharma sector is on the cusp of a significant increase in merger-and-acquisition (M&A) activity in 2026, as a revitalized bull market allows major companies to allocate more capital for deals. According to a report released by Ernst & Young (EY) during the 43rd Annual J.P. Morgan Healthcare Conference, the total amount of capital designated for M&A among the top 25 biopharma companies has risen to $1.6 trillion, up from $1.3 trillion in the previous year. This surge in financial resources is expected to result in a notable increase in both the number and value of M&A transactions, while the market for initial public offerings (IPOs) is anticipated to remain sluggish.

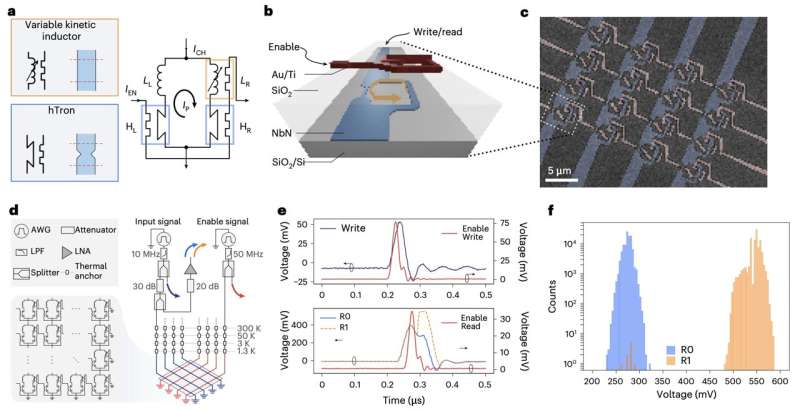

The EY report highlights a remarkable 66% increase in the value of biopharma M&A deals, which soared to $149 billion from $90 billion during the period from January to November 2025. Despite this impressive growth in deal value, the volume of transactions has decreased by 9%, from 94 deals in 2024 to 76 in 2025. The overall financial “firepower” available for biopharma M&A, including contributions from artificial intelligence (AI) and medtech companies, has reached $2.1 trillion.

According to Subin Baral, EY’s global life sciences deals leader, the fundamentals supporting this M&A surge remain strong. He stated, “We expect the surge to continue into 2026. The industry fundamentals continue to remain strong.” Key factors driving this growth include rapid advancements in innovation across various therapeutic areas, particularly in neuroscience, which accounted for $83 billion in M&A spending in 2025.

The recent M&A activity has had a significant impact on stock movements within the sector. For instance, shares of Ventyx Biosciences saw a 37% spike after Eli Lilly announced plans to acquire the company. Similarly, Revolution Medicines experienced a 29% increase in its stock price amid speculation of a potential acquisition by AbbVie, although AbbVie has denied these claims.

The ongoing M&A trend is partly attributed to the looming “patent cliff,” where several blockbuster drugs are set to lose patent exclusivity, leading to a projected loss of $176.442 billion in sales between 2026 and 2029. This impending financial gap is causing biopharma giants to seek new opportunities through acquisitions to replenish their portfolios.

China and AI Fueling M&A Growth

The emergence of China as a biopharma powerhouse is also reshaping the landscape of M&A. The country accounted for five of the ten highest-value M&A deals in 2025, representing 34% of total investments from U.S. and European biopharmas, a dramatic increase from 4% in 2020. Baral noted, “We are seeing the bio-bucks that are going into China. It’s almost like 1 in 3 bio-bucks is spent in China.” This trend indicates a growing interest in China’s faster and more cost-effective pathways to global commercialization.

Moreover, the integration of AI technology into the biopharma sector is transforming how companies approach R&D and deal-making. The EY report reveals a staggering 256% increase in the potential value of life sciences deals targeting AI technology platforms, climbing from $1 billion in 2014 to $49.6 billion in 2025.

Despite the optimism surrounding M&A activity, the IPO market remains weak. According to EY, biopharmaceutical companies executed IPOs valued at $1.755 billion through September 30, marking a 56% drop from $3.995 billion in 2024. Although some companies, such as Aktis Oncology, are preparing to enter the IPO market, Baral expressed caution, stating that while there may be slight improvements, a substantial rebound is unlikely.

This ongoing M&A trend reflects not only the shifting dynamics of the biopharma industry but also highlights the challenges faced by companies as they navigate a complex landscape marked by innovation, competition, and the pressure of patent expirations. As the sector continues to evolve, companies are expected to focus on executing deals that can swiftly translate into effective treatments for patients.