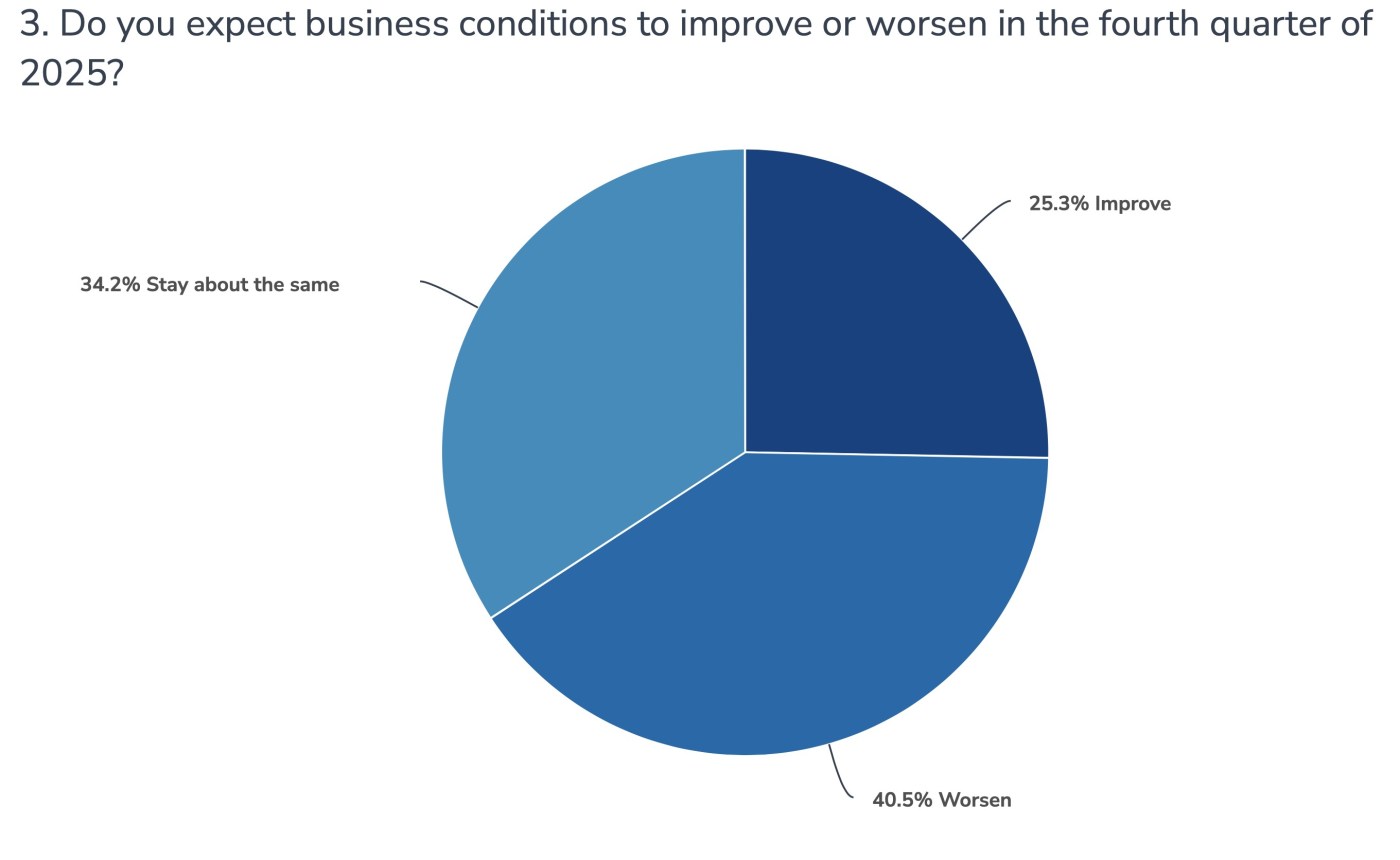

UPDATE: A new survey reveals a divided outlook among executives in the Boulder Valley and Northern Colorado for the fourth quarter of 2025. Conducted by BizWest, the CEO Roundtable Executive Survey shows that while a majority of leaders expect business conditions to remain stable or improve, a staggering 40.5% anticipate a downturn.

The survey, which gathered insights from C-level executives, indicates that 34% of respondents foresee no change in economic conditions, while 25.3% expect improvement. This stark contrast highlights the uncertainty gripping the region as businesses brace for potential challenges ahead.

One respondent candidly noted, “The economy is stuck and stagnant, leading to fewer projects,” underscoring a palpable sentiment of caution. Just 17.7% of executives reported that current conditions are better than six months ago, with 38% stating that conditions have worsened.

The ramifications of increasing tariffs are also weighing heavily on local businesses. 75% of survey participants believe tariffs will negatively impact their operations, with 16.5% indicating a very negative effect. The survey’s findings reflect a growing concern about external economic pressures that could hinder growth.

In terms of staffing, 63.3% of executives expect employment levels to remain steady, while only 13.9% foresee a moderate increase. The outlook for capital expenditures is similarly subdued, with 50.6% predicting no change in spending.

Housing availability is another critical issue, with 57.6% of respondents acknowledging a negative impact on their employees. The survey highlights the urgent need for solutions to improve housing conditions, as 39.7% of executives described the situation as somewhat negative.

Among the diverse industries represented in the survey—ranging from agribusiness to technology—executives voiced concerns about state regulations and unpredictable capital markets. One business leader stated, “State laws and regulations are driving out residential real estate investors,” emphasizing the detrimental effects of current policies on commercial real estate.

The challenges don’t end there. Executives in the mortgage industry reported that the greatest opportunity lies in new products emerging in the market, yet they face hurdles from excessive regulations established in previous administrations.

Looking ahead, the survey indicates that 20% of companies may require new facilities, while nearly two-thirds of executives anticipate no change in office space requirements for 2025. With so many uncertainties, businesses must navigate a complex landscape as they prepare for the coming months.

As the 2025 fourth quarter approaches, leaders in the Boulder Valley and Northern Colorado will need to remain agile amid mixed economic signals. The survey, sponsored by Plante Moran and Elevations Credit Union, serves as a crucial barometer for local businesses striving to adapt to an ever-changing environment.

Stay tuned as we continue to monitor this developing story and its impact on the regional economy.