BREAKING: Federal prosecutors have launched a criminal investigation into the Federal Reserve’s $2.5 billion renovation of its headquarters in Washington, DC. This urgent development, confirmed earlier today, raises serious questions about financial oversight and accountability at one of the nation’s key economic institutions.

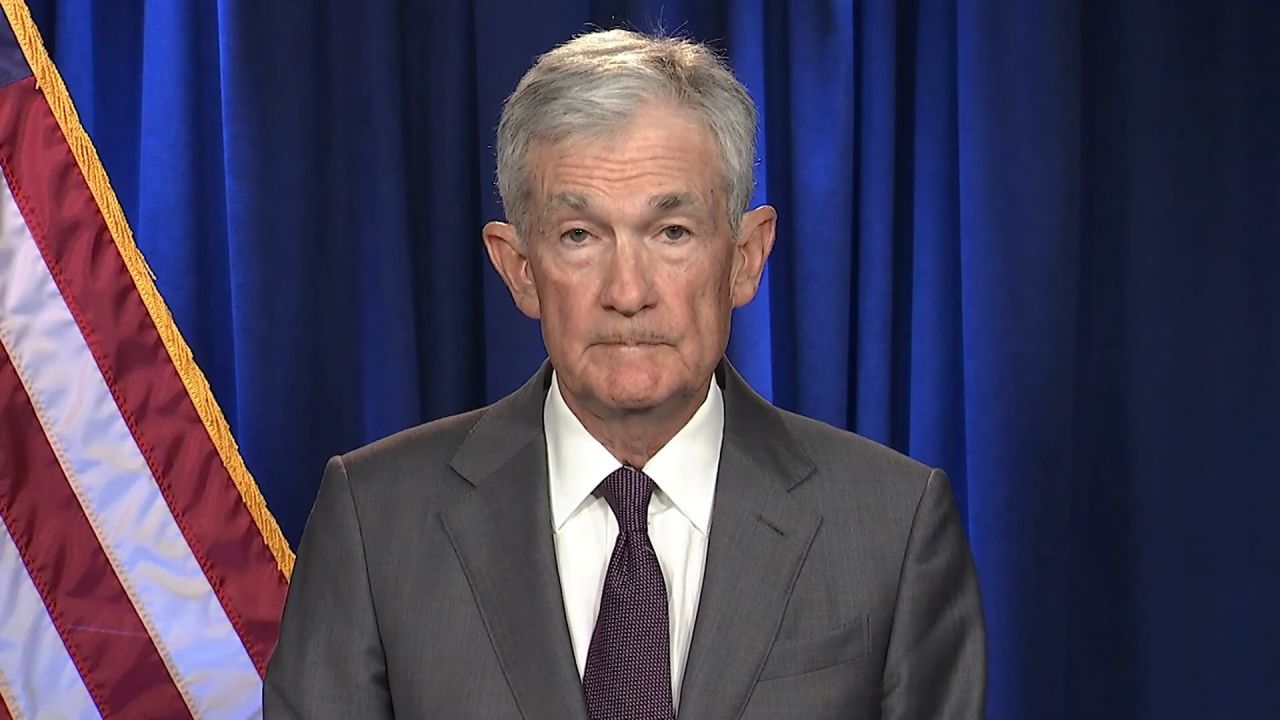

The investigation centers around the extensive renovations that have been ongoing for several years, with prosecutors examining the procurement processes and potential mismanagement of funds. This probe could have significant implications not just for Federal Reserve Chairman Jerome Powell, but for the institution as a whole, which plays a critical role in shaping monetary policy and maintaining economic stability.

The timing of this investigation is particularly sensitive, coming at a moment when inflation is a pressing concern for American families and businesses. As the Fed navigates these economic challenges, the scrutiny from federal authorities could undermine public confidence in its operations.

According to sources familiar with the matter, federal prosecutors are particularly interested in any irregularities that may have occurred during the bidding and contracting processes for the renovation. This investigation could lead to broader implications for financial governance in federal institutions.

Officials at the Federal Reserve have not yet publicly commented on the investigation, but insiders suggest that the organization is cooperating fully with authorities. As the investigation unfolds, the potential for legal repercussions could impact key decisions made by the Federal Reserve in the coming months.

As the story develops, analysts and investors will be closely monitoring any updates from both the Federal Reserve and federal prosecutors. The outcome of this investigation could reshape perceptions of the Fed’s transparency and accountability.

What to Watch Next: Keep an eye on upcoming press releases from the Federal Reserve and statements from federal prosecutors. This investigation is likely to remain a hot topic in economic discussions, especially as it unfolds against the backdrop of ongoing monetary policy debates.

This situation is evolving rapidly, and its implications are significant for the future of economic governance in the United States. Stay tuned for the latest updates on this developing story.