UPDATE: The forex market is experiencing a significant liquidity crunch this morning, December 22, 2025, as traders brace for a quieter holiday period. With many wholesale market participants now closed, market volatility is expected to surge as Asian centers come online.

As trading thins, retail traders are urged to exercise caution until the market stabilizes after January 5. The absence of the other time frame (OTF) during the holiday season will likely lead to choppy trading conditions. Those who typically engage in forex trading may find it beneficial to preserve capital for more favorable opportunities in the new year.

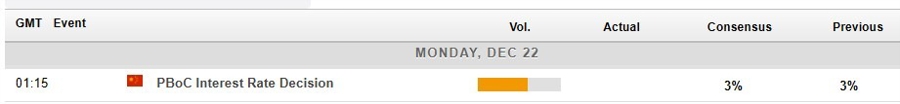

The People’s Bank of China (PBOC) has held its Loan Prime Rates (LPRs) steady for the sixth consecutive month as of November 2025, with no changes anticipated today despite the ongoing market shifts. The one-year LPR, which affects most lending, remains unchanged, and the five-year rate, which guides mortgage pricing, stands firm. Both rates were last adjusted downward by 10 basis points in May.

Currently, in the broader economic landscape, the PBOC’s reverse repo rate is set at 1.4% for the seven-day period, serving as a critical benchmark for interbank lending rates. This rate is pivotal in the PBOC’s strategies to manage liquidity within the banking system, influencing the overall lending environment in China.

Market analysts are closely monitoring these developments, particularly as the calendar for economic events is nearly empty, leading to an atmosphere of uncertainty. Traders should remain alert as any unexpected news or shifts could dramatically impact market conditions.

As a reminder, coverage on investingLive will decrease until January 5, but key updates will continue to be provided as necessary. Investors and traders alike are advised to stay informed and ready to adapt to the changing dynamics of the forex market during this holiday period.

Stay tuned for further updates as this situation develops.