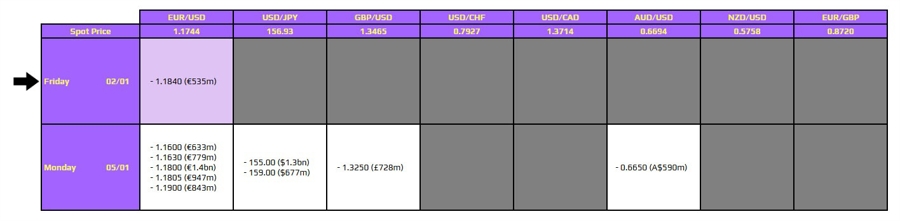

URGENT UPDATE: FX option expiries for January 2, 2026, have been confirmed at 10 AM EST in New York, but market activity remains subdued as traders enjoy the holiday break. With many participants still away, interest in the market is low, and no significant expiries are expected today.

As we transition into the new year, market liquidity is anticipated to gradually increase next week. However, traders should not expect notable movements on the expiries board today. The focus will shift to positioning flows in major currencies as the market gears up for 2026.

In the early trading hours, precious metals are drawing attention, with gold prices surging 1.5% to $4,378. Meanwhile, silver has jumped 3.9% to around $74.05. This rally in precious metals is likely to captivate market participants as they look to kick off the new year.

Market analysts emphasize that while the FX option expiries are minor today, the developments in gold and silver prices could have ripple effects across various trading strategies. Traders are encouraged to monitor these movements closely.

For detailed insights and guidance on navigating these early market dynamics, visit investingLive (formerly ForexLive) to stay informed.

As the market gears up for the upcoming week, expect trading volumes to increase, and keep an eye on how positioning strategies may influence currency values. Stay tuned for further updates as we continue to monitor these crucial developments.