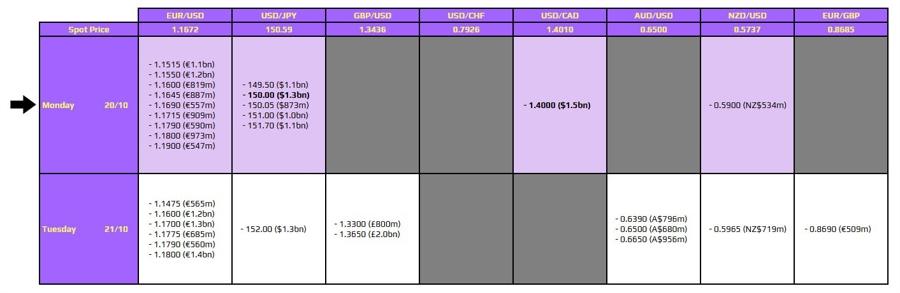

URGENT UPDATE: FX option expiries are set to impact the forex market today, October 20, 2023, at 10 AM New York time. Key expiries for USD/JPY are centered around the critical 150.00 mark, affecting trading decisions as political developments in Japan unfold.

The Liberal Democratic Party (LDP) and Nippon Ishin are reportedly aligning, which could position Takaichi as the next Prime Minister. This shift may signal an end to political uncertainty, a promising development for the yen. However, Takaichi’s reputation as a fiscal dove raises concerns about the yen’s potential strength moving forward.

The current market scenario shows USD/JPY balancing near its recent daily break below 150.00. The expiries are expected to moderate potential downside movement, while resistance appears around 151.00, coinciding with the 100-hour moving average. Traders should watch for modest expiries in this area, which could limit significant price fluctuations throughout today’s trading session.

Additionally, there is a notable expiry for USD/CAD at the 1.4000 level. Although this level lacks immediate technical significance, it may hinder further declines in the pair, especially after a downward drift since late last week. As this expiry rolls off later today, market watchers should remain alert to any shifts in trading patterns.

These developments are crucial for traders and investors alike, as they navigate the complexities of the foreign exchange market amid changing political landscapes. For more insights on utilizing this data effectively, visit investingLive (formerly ForexLive).

Stay tuned for further updates as the situation evolves, and prepare for potential market shifts as these expiries come into effect.